An Explanation of the National Debt and Deficit Print Share

Thursday, May 12, 2011

An Explanation of the National Debt and Deficit

There has been a lot of discussion the past few months about how to deal with our nation's rising deficit. There is no question that this is a problem we need to get our arms around. In order to better understand the deficit problem, here is a short explanation of the deficit and debt:

- A deficit occurs when the government spends more money than it raises in taxes that year. Then the government borrows money to make up the difference. This year—FY2011—the deficit will be about $1.4 trillion, so the federal government will have to borrow about $4,700 per person to pay for its operations and the services it provides. Over the last forty years, the federal government has had a deficit every year except for four years—1998 – 2001—when it had a surplus.

- The debt is the total amount of money the government has borrowed over all years, as well as the interest it owes on the borrowed money. The federal debt will top $15 trillion this year, or about $50,000 per person.

- About $10 trillion of the federal debt is publicly held debt—it is owed to people and foreign governments that have purchased U.S. Treasury Bonds.

- The remaining $5 trillion of the federal debt is owed mostly to the Medicare and Social Security trust funds. The Medicare and Social Security trust funds receive funds from payroll taxes which are intended to provide benefits for retirees in the future. The funds receive more money than they spend to fund the programs currently, so the funds are saved for the future. The trust funds currently contain about $2.7 trillion, which will keep Social Security solvent until 2035. However, the government borrows money from the funds to pay the nation's bills—and, in effect, owes money to itself.

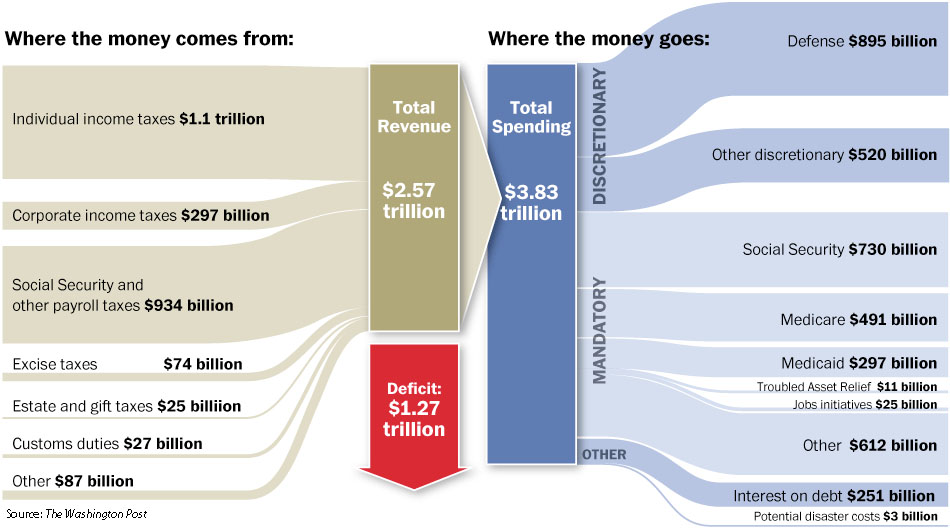

- Most of the federal budget is spent on defense and programs like Social Security and Medicare. See the graph below for a breakdown of government spending and revenues from last year, 2010:

A useful way to understand the size of the deficit and debt is to compare them to the size of the economy (GDP, or gross domestic product), because the bigger the economy, the bigger the debt it can support. This is similar to a home mortgage—the more money an individual or family has, the bigger the mortgage they can afford. Historically, the U.S. deficit has been about 3 percent of GDP; this year it will be about 9 percent, both because tax revenue has dropped to historic lows and spending has increased. Publicly held debt this year will be about 69 percent of GDP.

“ In order to better understand the deficit problem, which is a serious one, here is a short explanation of the deficit and debt. ”

You Might Also Like